How Early Can I Retire?

“How early can I retire?” is the golden question! To figure it out, you need to know your savings rate.

How Do I Calculate My Savings Rate?

Your savings rate is a primary indicator of how long it will take for you to reach financial freedom. The higher your savings rate, the quicker you’ll get to the ocean of financial independence.

If for some reason you’re spending more than 100% of your net income, your savings rate is less than zero and it’s time to change that, NOW. Debt is like a freaky seaweed monster wrapped around your leash while you are trying to paddle out. Stop paddling, and yank it off your leash!

If you’re spending exactly 100% of your net income, your savings rate is exactly zero, you’ll never retire early and you’ll be stuck in the rat race.

If you’re spending exactly 0% of your net income, because you have no expenses, your savings rate is 100% and you can retire right now. Dolphins know what’s up.

Net income = total income minus tax. Otherwise known as “take-home pay”

- Example: If your total income is $120,000 and you pay $20,000 in taxes, your net income is $100,000

Savings rate = the % of your net income that you save each year

- Example: If your net income is $100,000 and you save $60,000 then your savings rate is 60%

Not sure how much you’re saving? Check out the handy dandy tools to create “The Budge” on How Much Do I Need for Financial Freedom?

When Can I Retire?

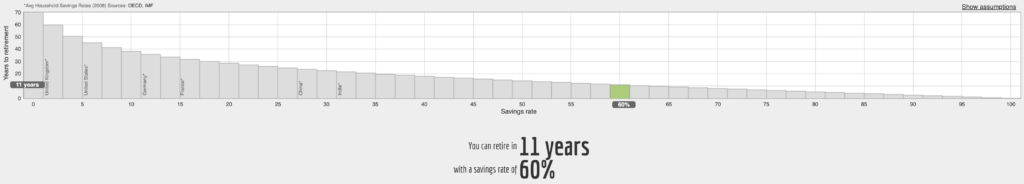

I’m so glad you asked. Checkout this calculator from mynetworthify.com

This shows that with a savings rate of 60%, and a net worth of $0, you can retire in 11 years!

Calculator assumptions:

- Your current annual expenses equal your annual expenses in retirement

- You will never draw down the principal. Your net worth will never shrink.

- Current annual income is after taxes

- Annual return on investment is after taxes and inflation

If you’re not already saving 60% of your income, you’re not alone! In 2023, the average savings rate in the United States was less than 5%. At that rate, required work lasts about 48 years. One of the issues is that a lot of people are bad at money, spending too much money on things that don’t bring happiness, and in fact bring the opposite in the form of fleeting endorphins, debt, often guilt and more years in the rat race.

If you’re thinking 60% or more savings rate is impossible, think again. Incremental improvement is the name of the game. Keep reading and take action. The beginning can be the hardest part. It gets easier and easier.

The Grower

When you save some money and invest, that money makes money. Then the money it makes starts to make its own money too. This is the wealth building, freedom inducing magic of compound interest. It’s kind of like a Grower.

Due to compound interest, your wealth grows quicker and quicker as time moves on.

Example:

- Save & Invest $10,000

- Year one of interest at 8% earns you $800

- Now you have $10,800

- Revinvesting that for a second year at 8% interest earns $864

- Now you have $11,664

See that? This my dudes and dudettes is the wealth building, freedom inducing magic of compound interest. Keep it up for years and the benefits literally compound faster and faster.

Remember, the best thing you can buy is your freedom.

Answer in the comments below: How many years until your own retirement?