How Much Money Do I Need for Financial Freedom?

Imagine early retirement is like a private lagoon with epic waves in the tropics. Out to the left is a machine like, hollow wave of perfection, something like I dunno…Cloudbreak.

To the right, a long roping right hander that alternates between tubes and steep rippable walls, let’s say, I dunno…J Bay.

On the inside is something a little more playful and rampy for gettin all tricky like I dunno…Dbah.

Somehow there’s even a natural hot spring at a toasty 103 degrees F to soak in afterward.

After surfing your brains out, what is there to eat? Lucky for you, there’s a healthy fish population. Just cast your line and pull out a yellowfin tuna to cook over the beachside fire.

But how can you make sure the fish last forever?

All you need to do is fish sustainably as if you were sustainably withdrawing money from your investments. Turns out, in the index fund world, that sustainable number is 4% per year. Or, 4 divided by 100 is 25. So you want to make sure that for every fish you want to eat, there are at least 25 more of them in the lagoon doing their fishy thing, swimming around and reproducing more fish that grow for you to eat when you’re hungry.

Just like the stock market, there will be fluctuations in the fish population from year to year but based on studies, 4% is a very safe withdrawal rate. We could deep dive here but we’re keeping it simple dudes and dudettes.

Let’s swing back to dollars. For every $1 you want to spend in retirement annually, you’ll need $25 invested in index funds. Adding some donuts, for every $10,000 you want to spend in retirement annually, you’ll need $250,000 invested in index funds. Want to spend $100,000? Invest $2,500,000. Oof, that’s a lot of donuts.

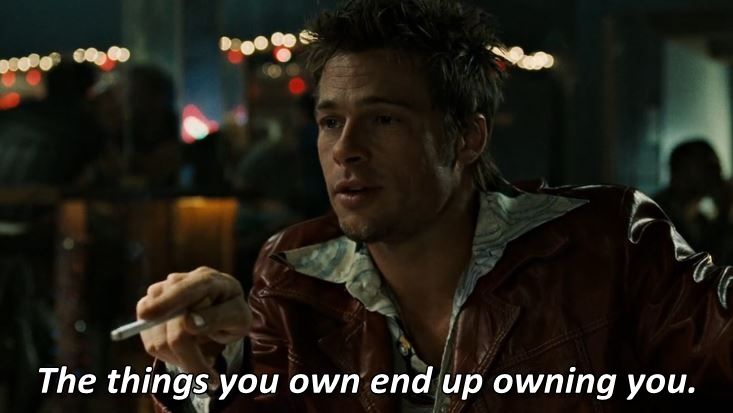

We can work backwards to your comfort level. For every $1,000 you trim off your annual spending, you can reduce your investment needs by $25,000! This is the power of conscious spending. If you like the idea of surfing your brains out, eating healthy and not buying a bunch of silly shit, cutback your spending to $40k annually and your target nest egg becomes $1M. Still want to finance that Sprinter Van? Maybe you can later with the magic of compound interest, but for now, focus on what brings you the most stoke and remember that financing expensive stuff can actually keep you from surfing more.

Budget, AKA “The Budge”

Don’t stick your head in the lip, hiding from how much money you’re spending.

You need to put on your big boy or girl pants on to understand how much money you’re spending. Your freedom depends on it.

To figure out your budget or “the budge”, your challenge is to track your spending for:

- 30 days (good)

- 90 days (better)

- 1 year (best)

One year is best since there can be annual spending, like the holidays, that tend to be higher than other months of the year. Also, remember, annual expenses like car insurance, life insurance, income taxes, property taxes, surf trips, etc. Your personality will come into play with how specific you want to get here. Some people like decimals, some people like round numbers. Some people don’t like numbers at all but come on, we’re talking about your financial freedom here. Get with it.

Fortunately, there are great tools that can help you:

- You Need a Budget (YNAB) – They actually have a sense of humor about it. Read our full review.

- Empower Budget Planner – Conveniently combines budgeting and investing

Got “the budge”? Congratulations! This is a huge step in your journey to financial freedom. Let’s party.

Now, estimate your financial independence number (FI number). Here’s the formula:

- Annual expenses x 25 = FI Number

- Example: $50,000 x 25 = $1,250,000

At this point you may be thinking, “yeah, but what about…” Don’t worry, we can get to those details later. Right now, you need a general idea of what your target is. Take a relaxing walk on the beach

In the comments below, share your FI number and how it compares with what you were expecting