Way to Be Debt Free

Debt is like a freaky seaweed monster wrapped around your leash while you are trying to paddle out. Stop paddling, and yank it off your leash!

Like seaweed on your leash, slowing your paddle out, debt will slow your financial freedom in a really bad way. If you carry debt, you need to understand how it’s affecting you and take action.

Good Debt vs Bad Debt

Yes, there is “good debt” which is usually tied to an appreciating asset. Think mortgage on your home.

And yes, there is “bad debt”, and even worse is “really bad debt” and “two-wave hold down debt”. Think student loans, car loans and credit card debt.

How Bad is Bad Debt?

It’s soooo bad. Seriously.

Picture this…you casually walk into your local surf shop to get some wax because the water is warming up for summer.

The rack of fresh boards catches your eye and you check ’em out. They are so new and fresh, perfectly smooth and light.

You pick up a board that speaks to you. It’s the new shape you’ve seen in the water and you want it.

The little sticker shows a price tag of $999. Well, at least it’s not $1,000, ha!

You know in your gut that it’s a lot of money but it’s been a hard week at work and you tell yourself that you “really deserve it”.

If you put it on a credit card and make minimum payments, get ready for a flogging.

Math and stuff:

- $999 surfboard

- $45 traction pad

- $0 leash thrown in by the surf shop

- Total = $1,043 plus 7.25% tax

- Grand total = $1,119

But if you’re just making minimum payments on your credit card, your payoff looks something like this:

Screenshot from Bankrate Minimum Payment Calculator

Wait, you’d pay over twice the amount for the same board and it would take over 10 years to pay off?! Yup.

I’m mad just typing this. And it gets worse.

Opportunity Cost

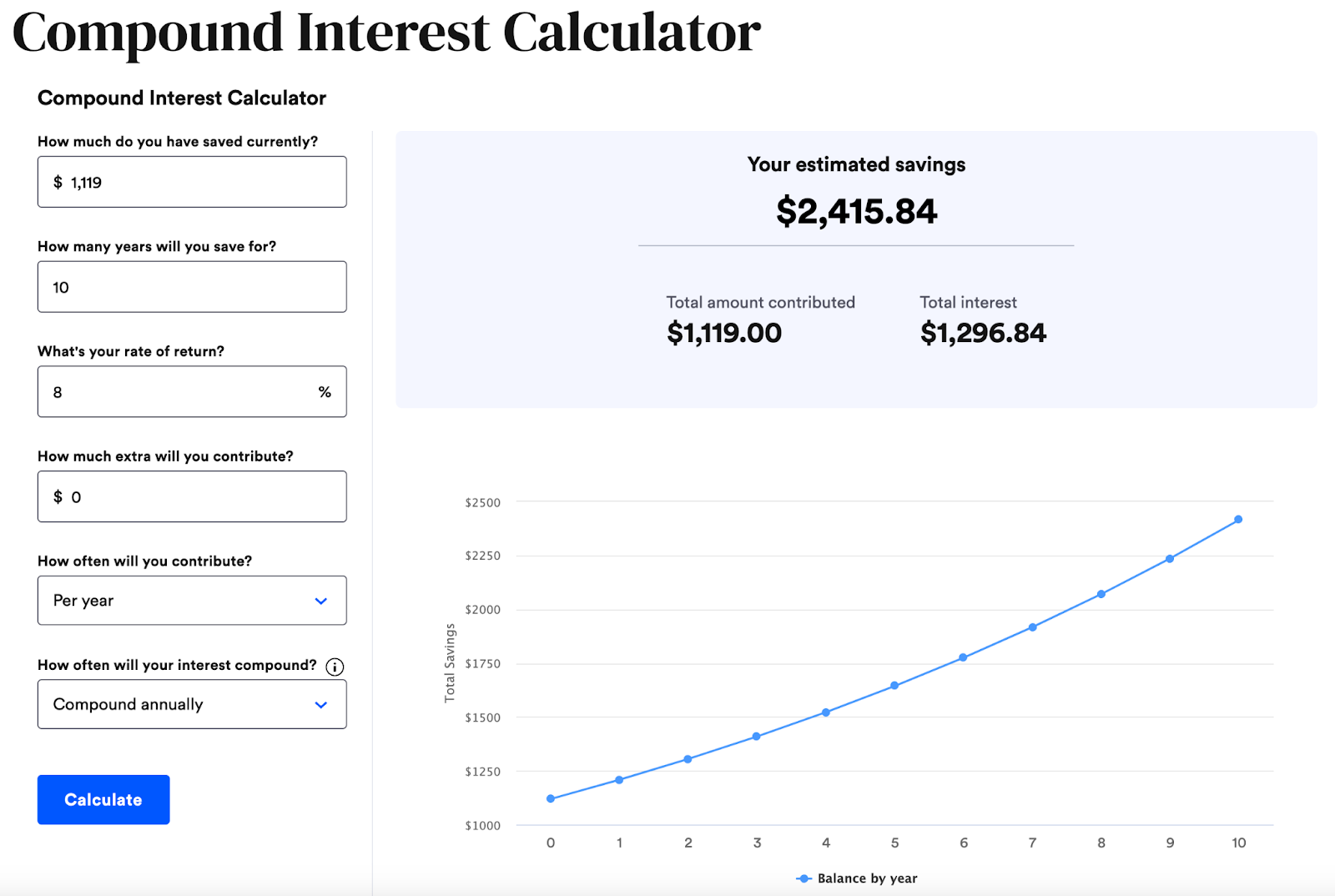

What if you invested that money in index funds instead? It could look something like this:

Screenshot from Bankrate Compound Interest Calculator

That’s right, if you invested that money, it would more than double in 10 years and you could buy two boards. Better yet, keep it invested and let it continue to compound, doubling every 10 years.

If you buy the surfboard, you’re in the hole $2,374 but if you invested it, you’ve got $2,415. When you combine the two, it’s a difference of $4,789 in wealth.

Of course, one purchase isn’t going to set you back forever. But if it’s a recurring theme, it’s gonna cost ya.

One of my favorite concepts in financial freedom is, “You can have anything you want but not everything.”

But wait, I love trying new boards

I know, me too. That’s why I love new-to-me boards.

Instead of accruing bad credit card debt, save cash for the same board, lightly used for $600 on a site like Offer Up.

Yes, there is opportunity cost here too, but it’s almost half. Then ride it for a year, sell it for $500, and pick up another new-to-you board for $600.

You’re getting stoked on a nearly new board every year for $600 up front then just $100 more per year. High five!

What is good debt?

Good debt is most commonly debt on an appreciating asset like a home, in which the interest rate is relatively low.

For example, if your mortgage has an interest rate of 4%, and you’re considering paying it down or investing in index funds at 8% returns, you’d probably end up with more money if you invested it.

Just because mortgage rates may be lower than index funds returns, I don’t recommend buying the most expensive house you can get a loan for.

This still costs money and can lengthen your path to financial freedom.

What now?

If you have debt, you need to tally it up and take action. Do this:

- Make a list of all your debts, ranked by interest rate

- Pay all minimum payments for each debt

- Then pay off the debt with highest interest rate first, until the balance is $0

- Then move on to the next highest interest rate, pay it down to $0 and so on

- If the interest rate is:

- higher than 5%, pay it off ASAP

- 3-5%, do what makes you happier

- lower than 3%, pay it off slowly so that you can invest more money in index funds

Once you are done paying off your debts, you are debt free. This feels absolutely amazing and worth the focus and resolve it takes to get there. Enjoy being a debt free surfer!

What will you do when you are debt free?